What Can Onions Teach Us About Oil Speculators?

“[E]ven with no traders to blame, the volatility in onion prices makes the swings in oil and corn look tame, reinforcing academics’ belief that futures trading diminishes extreme price swings.”

By Mark J. Perry

Onions have no futures market, yet their price volatility makes the swings in oil prices look tame.

Fortune Magazine (June 30, 2008) — “Before the government starts scrutinizing the role that speculators may have played in driving up fuel and food prices, investigators may want to take a look at price swings in a commodity not in today’s news: onions.

The bulbous root is the only commodity for which futures trading is banned. Back in 1958, onion growers convinced themselves that futures traders were responsible for falling onion prices, so they lobbied an up-and-coming Michigan Congressman named Gerald Ford to push through a law banning all futures trading in onions. The law still stands.

And yet even with no traders to blame, the volatility in onion prices makes the swings in oil and corn look tame, reinforcing academics’ belief that futures trading diminishes extreme price swings.”

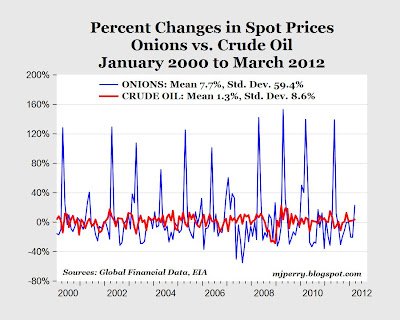

MP: The chart above shows the monthly percent changes in spot prices for crude oil and onions between January 2000 and March 2012. During that period, onion prices have been about 7 times more volatile than oil prices, based on the differences in: a) mean monthly price changes (7.7% for onions vs. 1.3% for oil), and b) the standard deviations of monthly price changes (59.4% for onions vs. 8.6% for oil).

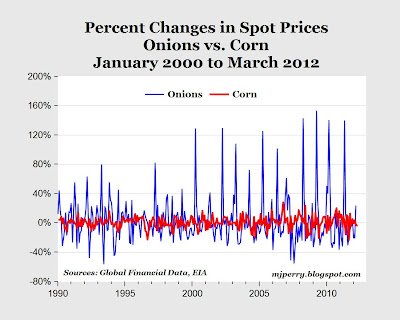

Update: The chart below compares the monthly percent changes in spot prices for onions and corn over the same period as onions and oil prices above, as an exercise in comparing the volatility of the prices of two agricultural commodities. One might argue that a comparison of oil and onion prices might not be valid if there are differences in agricultural commodity prices and energy prices. The fact that the volatility of onion prices is so much greater than the volatility of corn prices lends further statistical support to the notion that markets with futures trading like corn have lower price volatility than markets without futures contracts like onions.

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: