On Government Spending and Job Creation

The more the government has spent, the more people have lost their jobs. The simple correlation between government spending and jobs has been a negative 0.9.

by Mark A. Calabria at Cato@Liberty

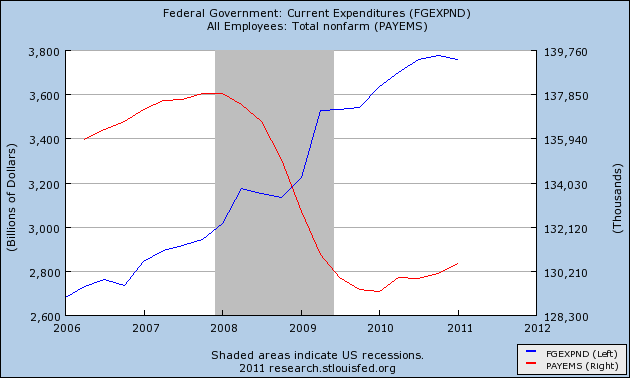

The standard Keynesian policy proposal for a weak economy is to have the government spend more money, and run deficits to do so. Clearly much of current government spending is being financed by borrowing. So current conditions are not subject to the New Deal critique that it was mostly paid for by taxes, as during the Great Depression. Current federal expenditures have increased about 41% since the housing market peaked in 2006. Has all this government spending generated many jobs? While keeping in mind that correlation is not the same as causality, it is interesting that the trend in government spending and total non-farm employees mirror one another, but not in the way you’d like. The more the government has spent, the more people have lost their jobs. The simple correlation between government spending and jobs has been a negative 0.9. Also worth noting is that both the decline in jobs and increase in government spending began well before the financial crisis of Sept 2008. In fact, almost 2 million jobs were lost between the beginning of the recession in Dec 2007 and the financial crisis in Sept 2008. Again, I won’t pretend this proves anything, however, it does suggest to me that continued massive government spending is not going to turn around the job market.

Mark A. Calabria, is director of financial regulation studies at the Cato Institute. Before joining Cato in 2009, he spent six years as a member of the senior professional staff of the U.S. Senate Committee on Banking, Housing and Urban Affairs.

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: