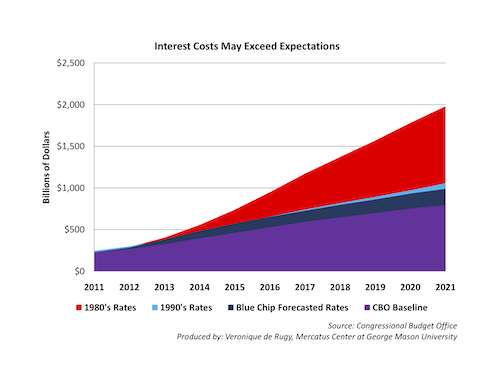

Interest on national debt could triple to $2 trillion

If interest rates were modified to reflect the average rates in the 1980s, in 2021, our interest payments would nearly triple from CBO’s projection of $749 billion to $2.0 trillion. Accumulated interest payments over this period would double from their current projected level of $5.7 trillion dollars to $11.0 trillion dollars.

Veronique de Rugy at Mercatus Center

This week, Mercatus Center Senior Research Fellow Veronique de Rugy examines the projected cost of our debt. When the Congressional Budget Office’s interest rate assumptions are modified to reflect historical interest rates and private sector forecasts, the costs of servicing our debt over next ten years balloons. For instance, if interest rates were modified to reflect the average rates in the 1980s, in 2021, our interest payments would nearly triple from CBO’s projection of $749 billion to $2.0 trillion. Accumulated interest payments over this period would double from their current projected level of $5.7 trillion dollars to $11.0 trillion dollars. Needless to say, the impact of these increased interest costs on the deficit would be huge.

The only way to address the increasing costs of our debt is to address the driving forces behind it – legislated explosions in Social Security, Medicare, and Medicaid spending.

Veronique de Rugy is a senior research fellow at the Mercatus Center. She was previously a resident fellow at the American Enterprise Institute, a policy analyst at the Cato Institute, and a research fellow at the Atlas Economic Research Foundation. Her research interests include the federal budget, homeland security, taxation, tax competition, and financial privacy issues.

Read the full PDF report

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: